The easiest way to manage equity

Simplified equity split management for early stage startups, with powerful tools designed for your growth journey

Sign Up for Free

Forever free. No credit card required

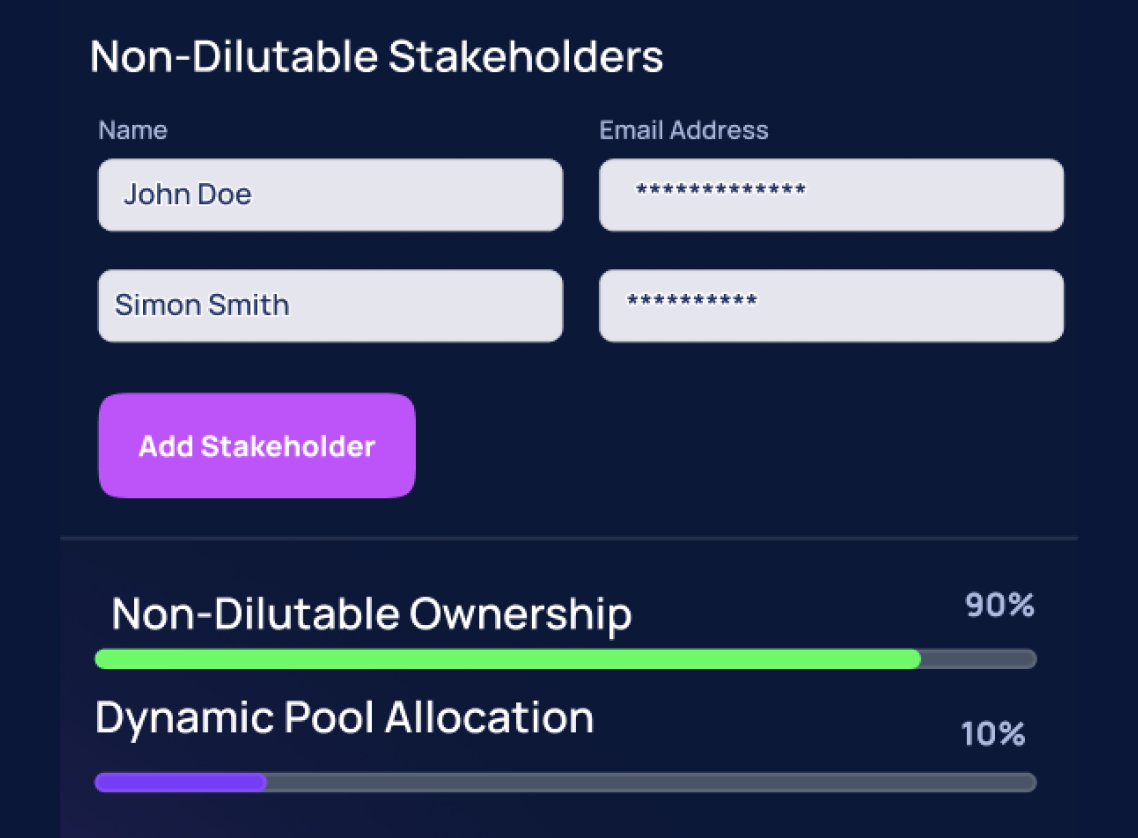

Reward your contributors with equity without diluting the ownership of original founders

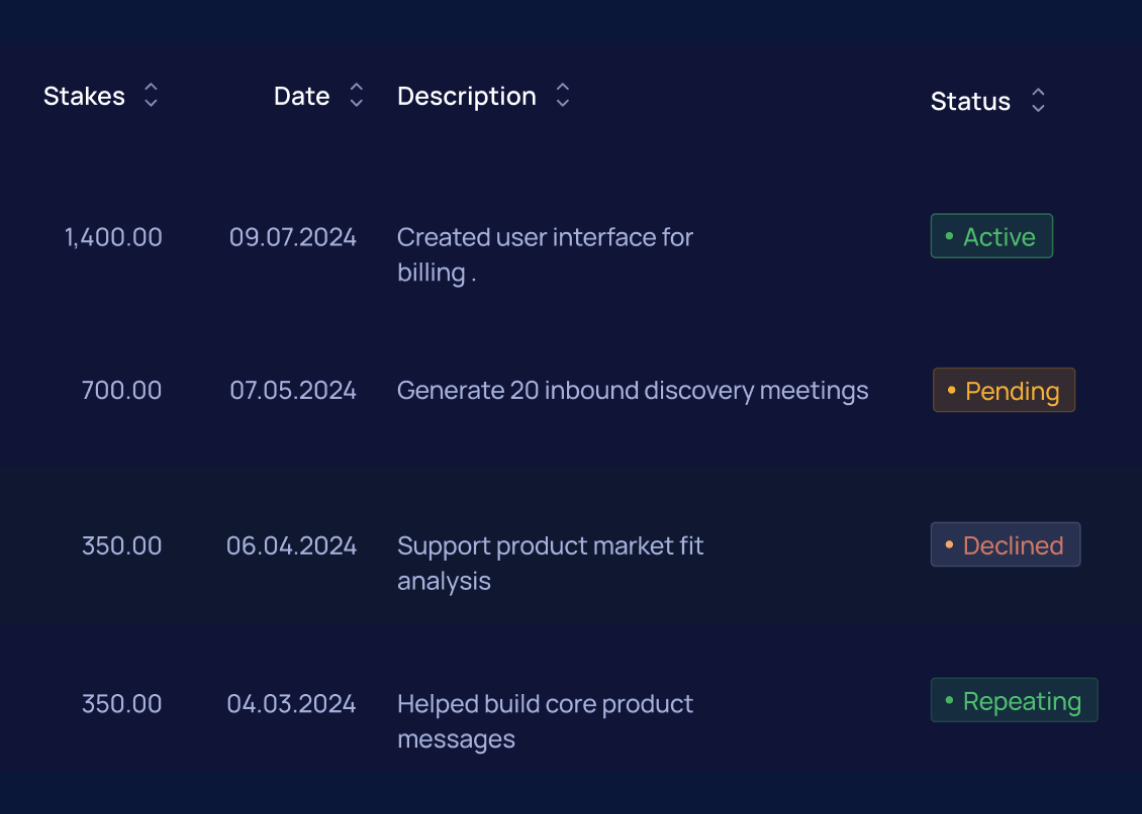

Keep track of contributions and deposits made towards your venture in one place

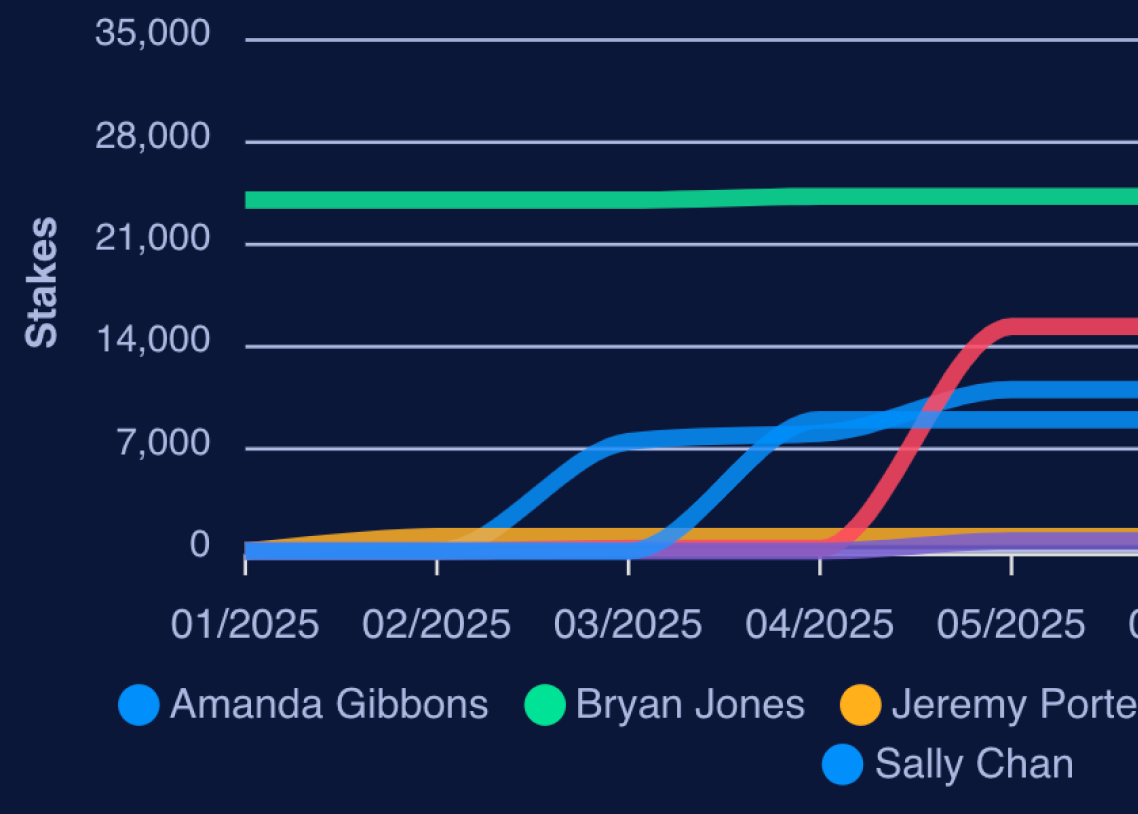

Reward your team with stake allocations tied to measurable contributions

Let us handle the math while you focus on growing your business

“Stakeforward simplified how we manage equity. It’s simple, fast, and keeps our team motivated.”

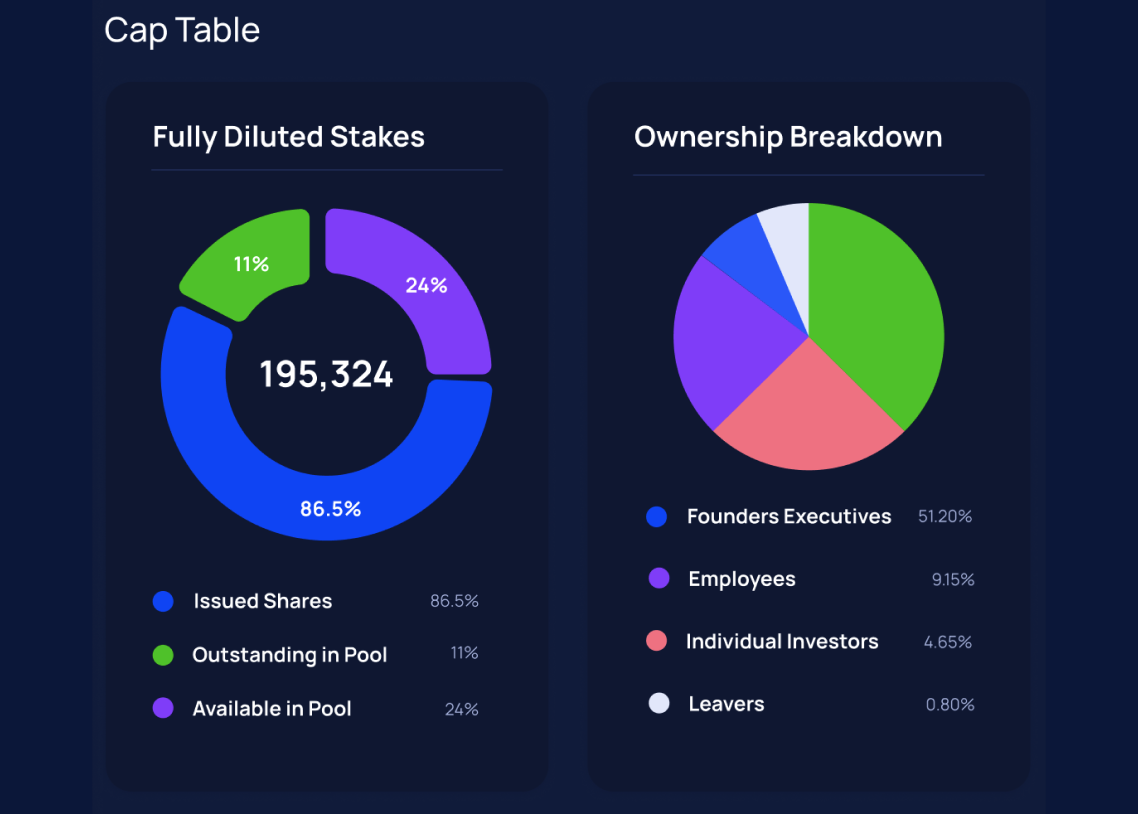

Gain real-time clarity into your ownership structure, accessible at any time

Easily manage equity with dynamic pools that grow with your teams or fixed pools for predictable stakes.

Visualize dynamic equity data for up to the minute tracking and better decision making

Motivate your team with equity rewards tied to measurable performance metrics

Transition seamlessly to Scale to manage shares and equity with advanced tools

Yes, it is completely free, with no hidden fees

Yes, you can easily upgrade when you’re ready

It simplifies equity management so you can focus on scaling your business.

Seed is tailored for startups. Scale is coming soon and designed for growth-stage companies